This animation shows how a Pelamis Wave Energy Converter works. I don't have any numbers on the cost per kilowatt hour for wave power but I have to say, it looks simple and cheap. What's more, wave energy is as reliable as the spinning of the earth. Also, in a scenario straight out of a cyberpunk novel, Google is looking to build massive off shore data centers powered by Pelamis Wave Energy Converters.

das kapitalism

Commentary on economics and other matters of concern to capitalists.

Wave Power

This animation shows how a Pelamis Wave Energy Converter works. I don't have any numbers on the cost per kilowatt hour for wave power but I have to say, it looks simple and cheap. What's more, wave energy is as reliable as the spinning of the earth. Also, in a scenario straight out of a cyberpunk novel, Google is looking to build massive off shore data centers powered by Pelamis Wave Energy Converters.

Gov. Palin has it Right On Energy Policy

Obama's Shameful "Windfall" Tax On Oil Companies

Here is the Obama campaign's explanation of Obama's proposed windfall tax.

Here is the Obama campaign's explanation of Obama's proposed windfall tax.

Barack Obama will require oil companies to take a reasonable share of their record-breaking windfall profits and use it to provide direct relief worth $500 for an individual and $1,000 for a married couple. The relief would be delivered as quickly as possible to help families cope with the rising price of gasoline, food and other necessities. The rebates would be fully paid for with five years of a windfall profits tax on record oil company profits. This relief would be a down payment on Obama’s long-term plan to provide middle-class families with at least $1,000 per year in permanent tax relief. The Obama energy rebates will: offset the entire increase in gas prices for a working family over the next four months; or pay for the entire increase in winter heating bills for a typical family in a cold-weather state. In addition, Obama has proposed setting aside a portion of a second round of fiscal stimulus to ensure sufficient funding for home heating and weatherization assistance as we move into the fall and winter months.Hugo Chavez would be proud. Obama is using populist rhetoric to villanize oil companies in order to justify seizing their profits and using those profits to purchase votes. As Mark Perry points out on his blog, Oil Companies already pay more taxes than all the lower 50% of income earners combined and Exxon alone has paid over $20 billion in taxes in the first half of 2008. Where does it end?

Still No Northwest Passage

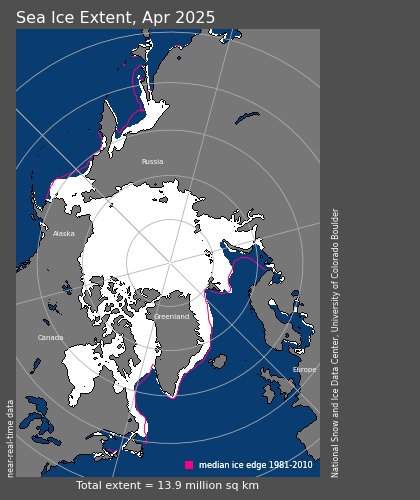

Global warming alarmists have been shown once again to have poor predictive powers. We heard a lot of hype recently in the media about all of the ice at the North Pole melting this summer. (In case you don't follow the news much and don't believe me see here, here, here, here, here, and here.) Well it didn't happen. By now we should be used to this. Remember when global warming was going to bring record hurricanes? That didn't happen either. Instead of a record loss of ice, what we got was the most ice since 2004. Don't take my word for it, visit the National Snow and Ice Data Center web site. Just to give an idea of exactly how far off the alarmists were. Below is an image of the 9 million sq km of ice at the North Pole in July of this year, just a small bit below the median for July.

Global warming alarmists have been shown once again to have poor predictive powers. We heard a lot of hype recently in the media about all of the ice at the North Pole melting this summer. (In case you don't follow the news much and don't believe me see here, here, here, here, here, and here.) Well it didn't happen. By now we should be used to this. Remember when global warming was going to bring record hurricanes? That didn't happen either. Instead of a record loss of ice, what we got was the most ice since 2004. Don't take my word for it, visit the National Snow and Ice Data Center web site. Just to give an idea of exactly how far off the alarmists were. Below is an image of the 9 million sq km of ice at the North Pole in July of this year, just a small bit below the median for July.

Of course, there are still six weeks left in the melting season so some are still raising concerns about the "thinning ice" and still say we may have open waters at the North Pole this summer. Fat chance.

Of course, there are still six weeks left in the melting season so some are still raising concerns about the "thinning ice" and still say we may have open waters at the North Pole this summer. Fat chance.HT: DaveScott at Uncommon Descent

It Is Not The Great Depression

Not shocking. A recent study conducted by the Business & Media Institute found that the media overhypes negative economic news and makes unwarranted comparisons of the current economy with the great depression. The study determined that this was in part the result of ignorance of economics and history and shallow "sound bite" reporting. Among the study's key findings:

Not shocking. A recent study conducted by the Business & Media Institute found that the media overhypes negative economic news and makes unwarranted comparisons of the current economy with the great depression. The study determined that this was in part the result of ignorance of economics and history and shallow "sound bite" reporting. Among the study's key findings:

- Modern Media Much More Negative: During the week of the 1929 stock market crash, daily news stories reported positive news more often than negative by a 4-to-1 ratio. The week that the Bear Stearns fall occurred, coverage was the complete opposite. Negative stories on ABC, CBS and NBC outnumbered positive 6-to-1.

- No Good News: Roughly 40 percent of the stories from 2008 contained no positive comments at all. On CBS, that percentage was even higher. Completely negative stories made up nearly 60 percent of its reports.

- It’s Not A Depression: Today’s journalists are making repeated connections to the largest economic crisis in modern times – often with the phrase “not since the Great Depression.” Only a few of those comments explained the differences between today’s economy and the nation’s darkest economic years, or bothered to note that America is not in a depression.

- Old Presidents Never Die…: The claim that President George W. Bush would be the first president since Hoover to lose jobs in his first term proved false, yet journalists repeated it more often than Democratic operatives. Journalists have been comparing Republicans to Hoover for several years and have already begun doing so with Sen. John McCain, the presumptive GOP presidential nominee.

- CBS the Worst: CBS consistently appears among the worst media outlets on the economy. This study was no different. Business reporter Anthony Mason was even called “the grim reaper” by his own anchor Katie Couric. In 2008 during the week of the Bear Stearns collapse, negative stories on CBS outnumbered positive by an 11-to-1 ratio.

- NBC the Best: NBC’s attempts to deliver balanced economic coverage can be summed up in two words – Maria Bartiromo. The star of sister network CNBC was a cautious voice reminding viewers that negative news can have an impact. “We could talk ourselves into a recession,” she told NBC’s “Today.”

Greenspan: Regulation and Protectionism Not the Answer

Alan Greenspan has an article today in the Financial Times where he comments on the current non-recession and argues in favor of the free market. It is a popular theme in the current political environment that the current housing and credit crisis was somehow created by government policy or lack of regulation. In fact, government policy had less to do with it than global forces in the financial markets and, as Greenspan puts it, "human nature’s propensity to sway from fear to euphoria and back." However, Greenspan warns, attempting to retreat from globalization would have "an awesome cost."

Alan Greenspan has an article today in the Financial Times where he comments on the current non-recession and argues in favor of the free market. It is a popular theme in the current political environment that the current housing and credit crisis was somehow created by government policy or lack of regulation. In fact, government policy had less to do with it than global forces in the financial markets and, as Greenspan puts it, "human nature’s propensity to sway from fear to euphoria and back." However, Greenspan warns, attempting to retreat from globalization would have "an awesome cost."

It has become hard for democratic societies accustomed to prosperity to see it as anything other than the result of their deft political management. In reality, the past decade has seen mounting global forces (the international version of Adam Smith’s invisible hand) quietly displacing government control of economic affairs. Since early this decade, central banks have had to cede control of long-term interest rates to global market forces. Previously heavily controlled economies – such as China, Russia and India – have embraced competitive markets in lieu of bureaucratic edict. The danger is that some governments, bedevilled by emerging inflationary forces, will endeavour to reassert their grip on economic affairs. If that becomes widespread, globalisation could reverse – at awesome cost.The full article is here.